Use short-term refresh options for fast-changing assets, while placing long-term solutions, like core software systems, on terms that match their expected lifecycles.

Software Financing

Upgrade critical software and systems with financing from First American.

From SaaS subscriptions to AI-enabled platforms, software is essential—but rising costs, complex implementations, and multi-year commitments can strain budgets and internal resources.

Software financing offers a flexible strategy to help control costs and manage long-term projects more effectively. Whether you’re in the early planning stages, mid-implementation, or have recently completed an upgrade, financing can help you unlock the full value of your investment.

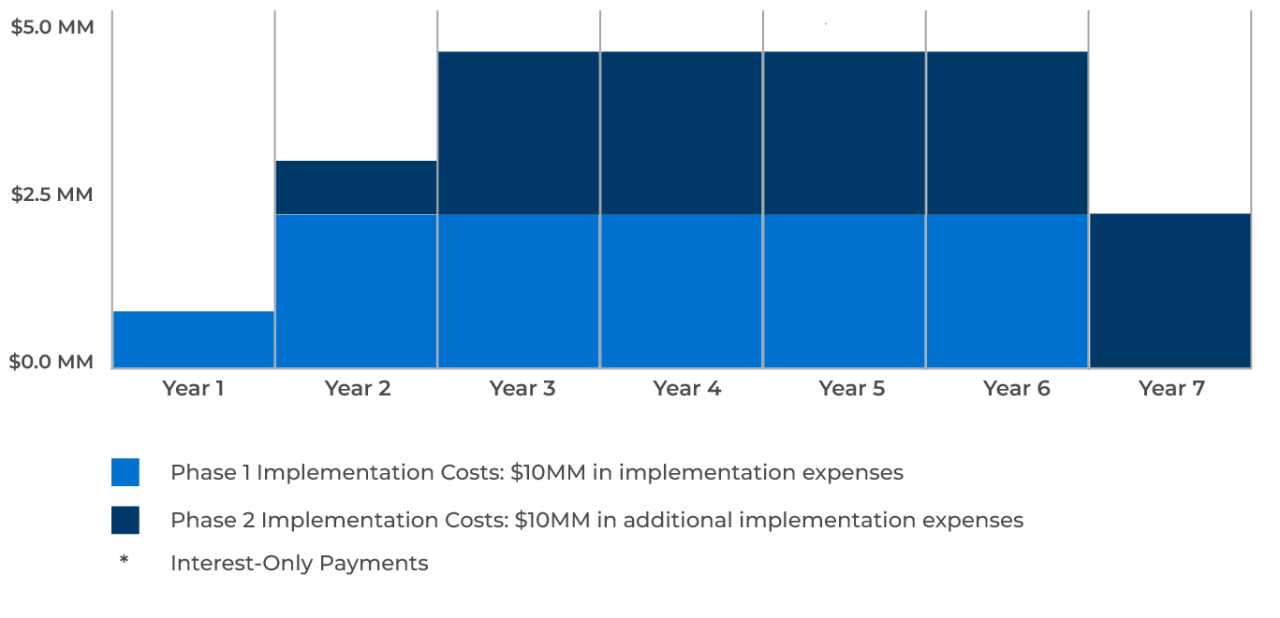

Financing Multi-Year Software Projects

Example is for illustrative purposes only.

Commonly Leased Software & Services

- SaaS subscriptions and enterprise licensing

- AI-enabled tools and data platforms

- ERP, CRM, and financial systems

- Content and digital asset management software

- Cybersecurity and risk management software

- Implementation, integration, and training services

- Cloud infrastructure and storage solutions

Recently Funded Software Projects

Software Leasing & Financing on Your Terms

3-7+ year term lengths

Rate locks

Align payments with expected ROI

All transactions are subject to credit approval. Eligibility for a particular service is subject to final determination by First American. Some restrictions may apply.

Interested in Learning More?

Tell us your business needs and we’ll give you specific financing recommendations and insights to help you get results.