The Right Financing Starts

with the Right People

Progress requires more than just capital; it demands bold investments in technology, equipment, and facilities. Explore how lease financing with First American can help you evolve and thrive in a rapidly changing market.

Specialized Support at Your Service

First American’s proven expertise in the Technology industry gives us a unique understanding of your organization’s needs. Through our specialized service model and forward-thinking solutions, we can help you unlock new opportunities, scale with confidence, and achieve your vision for growth.

Leading the Way in Leasing

By the Numbers

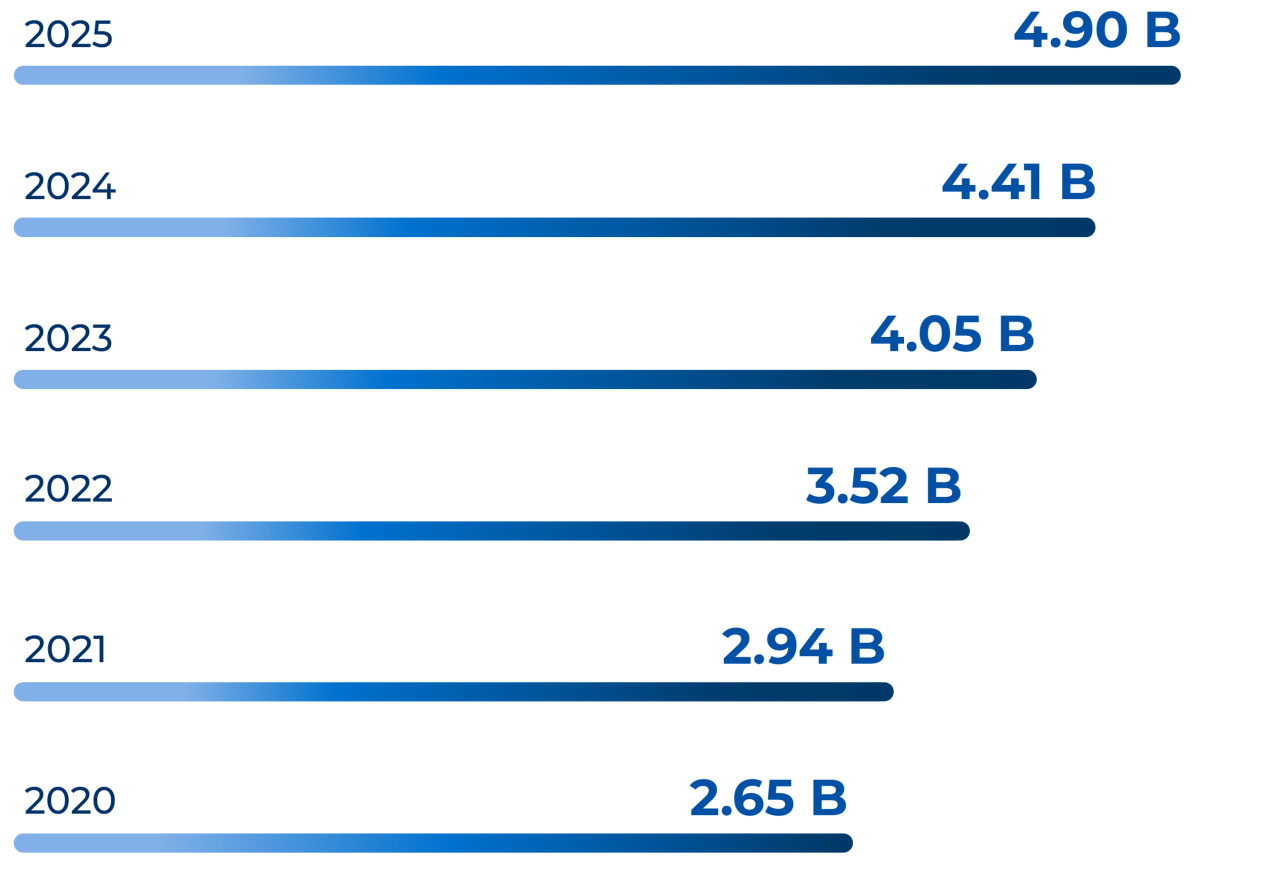

$4.9B

Finance Portfolio

Our disciplined lending approach, steady growth, and diverse portfolio translates into strength and stability for our clients.

157

CLFPs (the most in the world)1

First American employs more Certified Lease & Finance Professionals than any company in the world. Work with the best and the brightest in the industry.

12th Largest

Bank-Owned Equipment Finance Lessor in the U.S.2

With this nationwide reputation and a technology exclusive team, we are uniquely positioned to support your business.

U.S. Lease Portfolio

Powerful Stories from Your Peers

Interested in learning more?

Connect with us today to find out how we can help your business thrive.

1CLFP Foundation Member Directory

2Monitor 100 2025 | Vol. 52, No. 4

3All transactions are subject to credit approval. Eligibility for a particular service is subject to final determination by First American Equipment Finance. Some restrictions may apply.

4All credit cards are subject to credit approval. Terms and conditions apply. See the Commercial Credit Card Agreement and City National Rewards Program Terms, Conditions and Program Rules for details.